Back

25 Apr 2022

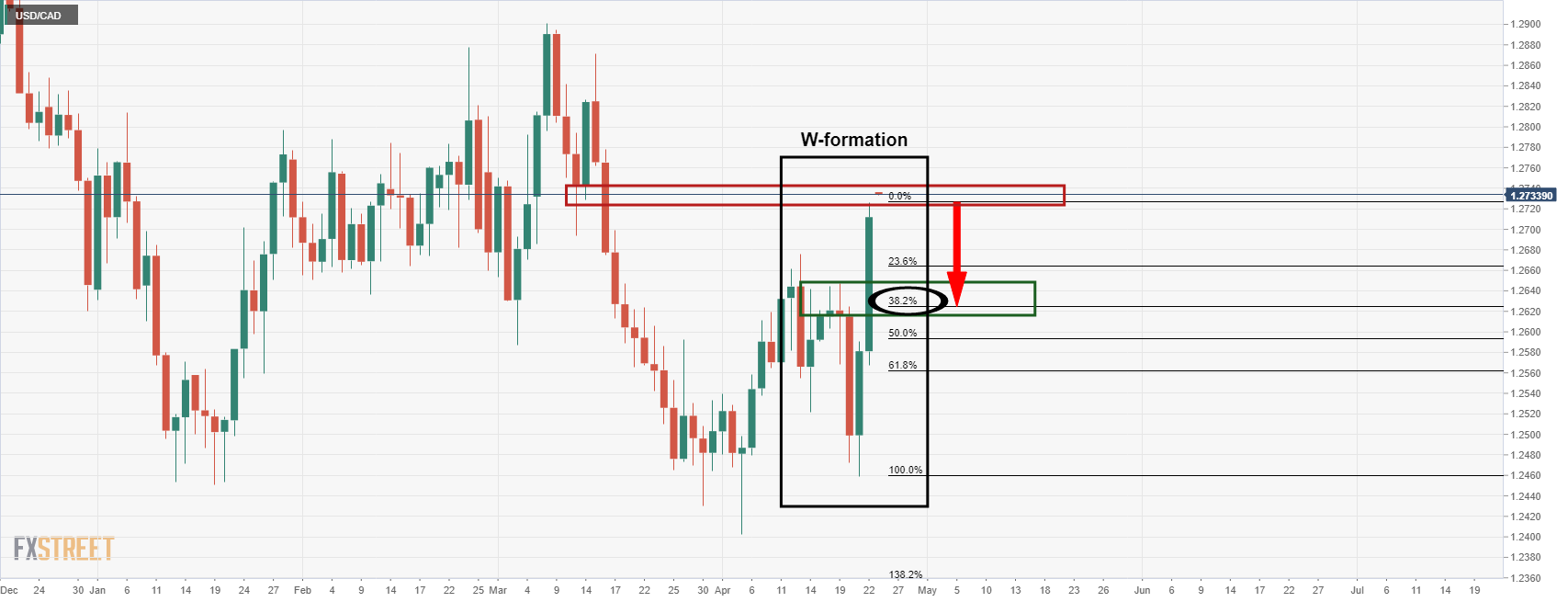

USD/CAD Price Analysis: Bears eye a 38.2% Fibo correction

- USD/CAD is meeting a potential resistance.

- The bears will not the reversion market structure that has formed on the daily chart.

At 1.2736, USD/CAD is consolidating near Friday's close after travelling between a low of 1.2699 and a high of 1.2743, higher by some 0.2% on the session so far. From a technical perspective, the price has extended the cycle bull trend on the hourly charts, but the price on the daily chart is at risk of correcting as per the market structure as follows:

USD/CAD daily chart

The W-formation is a bearish reversion pattern. The price is stalling at an old structure which could prove to be resistance. If so, then the 38.2% Fibonacci that has a confluence with a prior resistance area could be eyed by the bears as a reasonable target area.