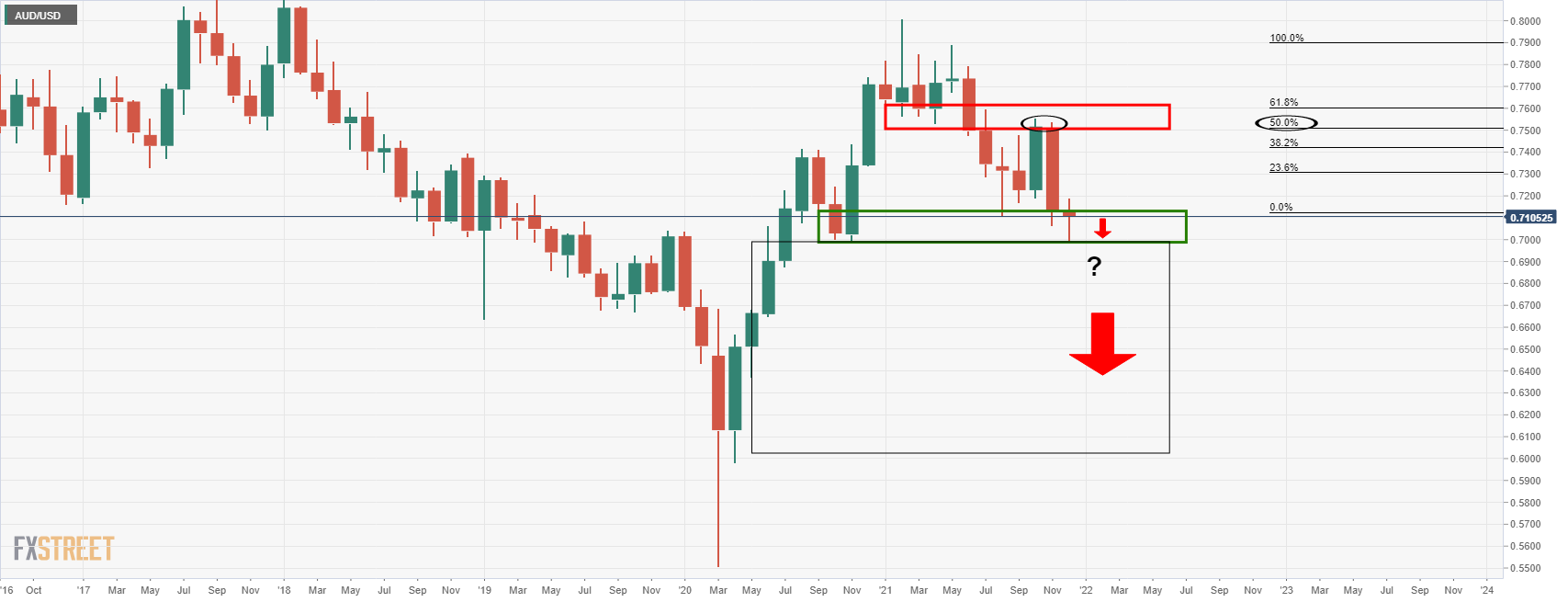

AUD/USD Price Analysis: A compelling case for the downside while below 0.7150

- AUD/USD bears have been in play this week and a downside continuation could be on the cards.

- The Federal Reserve is the main risk event, but Chinese data could create some volatility.

Chinse data is coming up later today, although the Federal Reserve will take the spotlight. From a technical point of view, there are compelling price actions and structures taking place across the time frames.

The price is leaving a bearish wick on this month's candle so far that could be filled next month, if not love the remaining days of the holiday season. This leaves scope to the downside for a test of 0.70 the figure.

AUD/USD monthly chart

However, the jury is out on whether the price can then exploit all of the space from 0.60s. But, if it does break below 0.7000, then there is plenty of downside opportunity.

AUD/USD daily chart

The daily chart has corrected 50% of the prior downside move from mid-Nov. This has resulted in the price breaking back to the downside and below a prior support structure, as eclipsed in the chart above. in doing so, the focus is back on the downside, in line with the monthly chart.

However, a retest of the old support is on the card between 0.7120/50. If this holds, then the bears will be encouraged to sell at a discount likely resulting in a downside continuation.

AUD/USD H1 chart

From an hourly perspective, the bias is also to the downside while below the 50 EMA. The price could still find some buyers here banking on the double bottom holding up and resulting in the upside. However, failure to move beyond 0.7150 should encourage sellers and potentially result in a downside continuation with 0.7050 eyed as the next downside target.