EUR/USD Price Analysis: Bears giving way, for now

- EUR/USD bulls attempting to take on the bear's commitments.

- Daily charts remain bearish ahead of the main event in NFP on Friday.

The bulls took over regardless of the bearish structure that was in platy following the Federal Reserve volatility and the lack of liquidity in markets has enabled the price to meander into Tokyo with no decisive bias. The W-formation is somewhat compelling but there are no signs that the bulls are going to step aside immanently.

EUR/USD H1 chart

Meanwhile, casting eyes over prior analysis, EUR/USD Price Analysis: Bears seeking a break below 1.15 the figure, the price still has room to go to the upside before bears might commit fully once again.

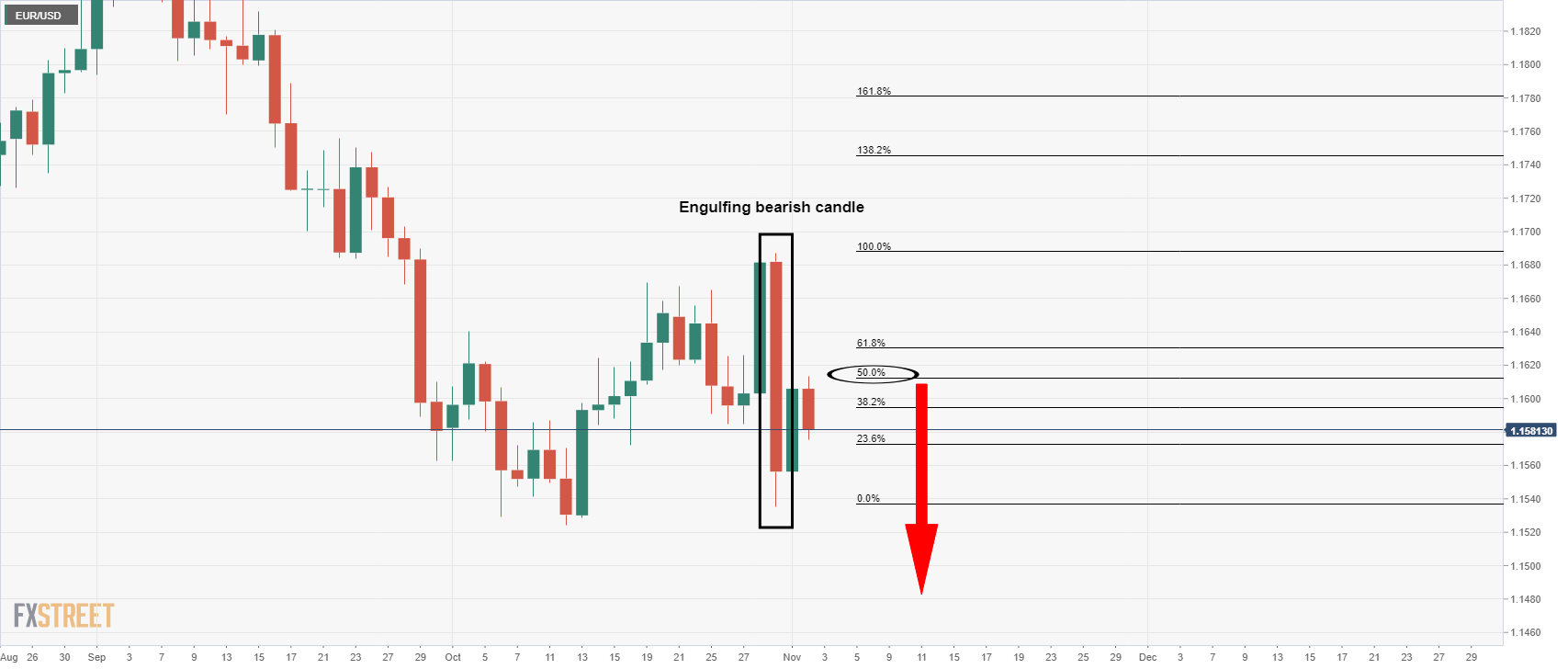

EUR/USD daily bearish engulfing candle

We had seen a strong momentum candle in the last few days which was yet to lead to a lower low. The price had instead corrected 50% of the imbalance in a phase of mitigation and a retest of liquidity.

EUR/USD live update

The price is attempting some further upside here, so best let this play out before banking on bearish bets.