Back

3 May 2021

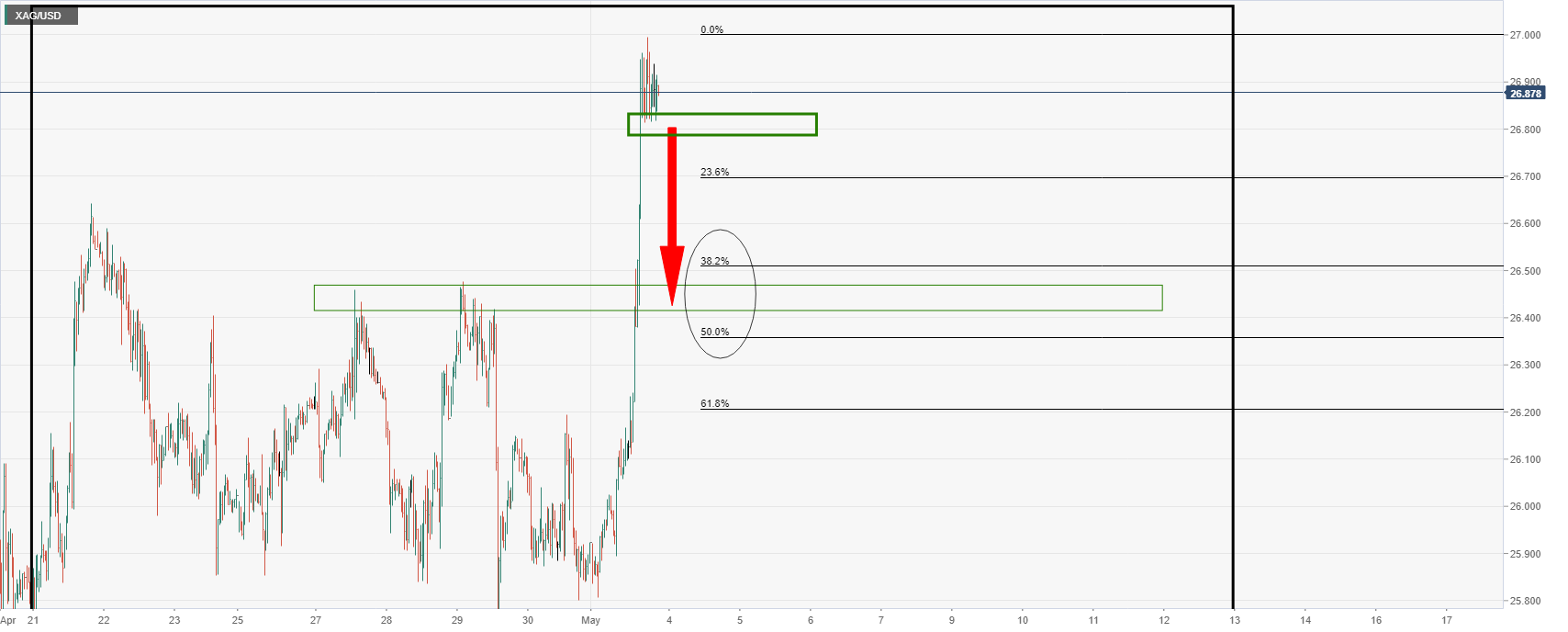

Silver Price Analysis: Break of near term support opens 38.2% correction

- XAG/USD bears looking for a correction to the W-formation's neckline.

- Bears can presume a weaker dollar, but the W-formation is a high probability chart pattern.

The moves today in the commodity space have been over-exaggerated, at least according to ATRs.

The CRB index is up just 0.55% which represents a fairly lacklustre environment, but the metals are nevertheless bid, proximately owed to the US dollar.

DXY has dropped by some 0.36% at the time of writing as markets get set for more US data this week, reversing some of what was looking to be the start of an unwind of an overly-subscribed short futures position.

Meanwhile, the silver has rallied to leave a W-formation on the daily chart where the neckline wicks meet a 38.2% Fibonacci confluence near $26.50.

Daily chart, XAG/USD

30-min chart