Gold Price Analysis: XAU/USD regains traction, tests $1,740

- XAU/USD reversed its direction after dropping toward $1,720.

- Renewed USD weakness is providing a boost to XAU/USD.

- Next hurdle on the upside is located at $1,740 ahead of $1,745.

The XAU/USD pair dropped to a daily low $1,723 in the early European session but made a sharp U-turn in the last hour. Boosted by a renewed selling pressure surrounding the greenback after the inflation data, gold climbed into the positive territory and was last seen gaining 0.3% on the day at $1,738.

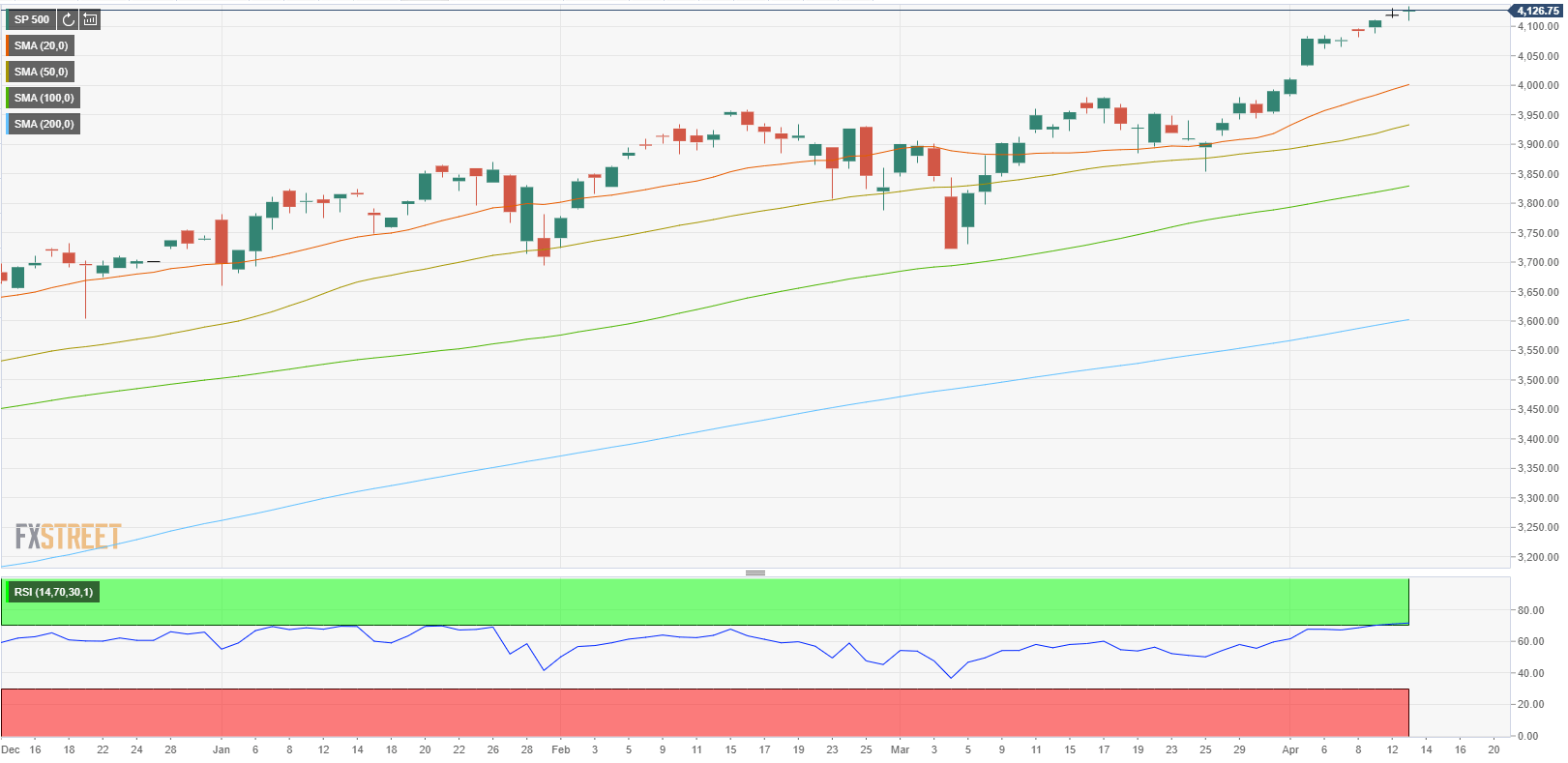

Gold technical outlook

The Relative Strength Index (RSI) indicator on the four-hour chart rose above 50 with the latest upsurge, suggesting that the bullish momentum is gathering strength. On the upside, the first hurdle is aligned at $1,740 (Fibonacci 23.6% retracement of Mar. 31 - Apr. 8 rally) ahead of $1,745 (static level). A daily close above the latter could open the door for additional gains toward $1,755, where the 50-day SMA is located.

On the other hand, the 50-period SMA acts as the first dynamic support at $1,735. Furthermore, strong support seems to have formed in the $1,723-$1,727 area (100-period SMA, 200-period SMA, Fibonacci 38.2% retracement). A daily close below that level could attract more sellers and trigger a bearish shift.