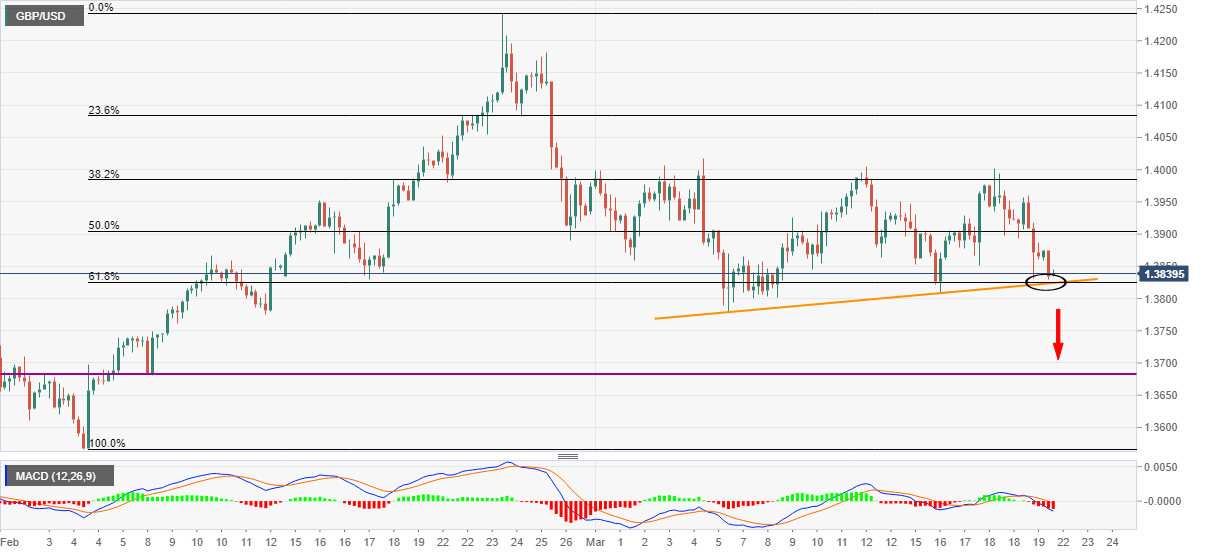

GBP/USD Price Analysis: Sellers attack 1.3820 support confluence with eyes on early February low

- GBP/USD drops towards three-week-old support line, 61.8% Fibonacci retracement of February run-up amid bearish MACD.

- Early February’s horizontal support lures the bears, bulls need decisive break above 1.4000 for fresh entry.

GBP/USD bounces off intraday low, stays depressed, while picking up the bids to 1.3842, down 0.23% on a day, amid an initial Asian session on Monday. In doing so, the cable extends last week’s pullback from the 1.4000 threshold amid bearish MACD.

However, GBP/USD sellers need to break solid support comprising an ascending trend line from March 05 as well as 61.8% Fibonacci retracement of the pair’s rise during the previous month, around 1.3820.

Given the downbeat MACD and failures to cross the key hurdle, not to forget the recently bearish fundamentals, GBP/USD is up for breaking the said support convergence near 1.3820, which in turn will direct bears towards an area comprising early February levels surrounding 1.3680.

Meanwhile, a corrective pullback can eye 50% Fibonacci retracement level around 1.3900 before trying to tackle the 1.4000 round-figure for one more time.

It should be noted that if at all the GBP/USD bulls manage to stay strong beyond 1.4000, February 24 low near 1.4080 and February 25 top near 1.4185 can offer intermediate halts during the rally to the last month’s high of 1.4243.

GBP/USD four-hour chart

Trend: Further weakness expected