Gold Price Analysis: After breaking $1,900, three bullish targets to watch – Confluence Detector

Gold has been extending its relentless march to the upside, smashing the $1,900 level and eyeing the all-time highs. Central banks have kept yields at rock-bottom levels and have been printing money. The European Union's recovery fund, approved this week,, joins hopes for the next stimulus package in the US.

Can all this money sloshing around send XAU/USD further above? How is the precious metal positioned on the chart?

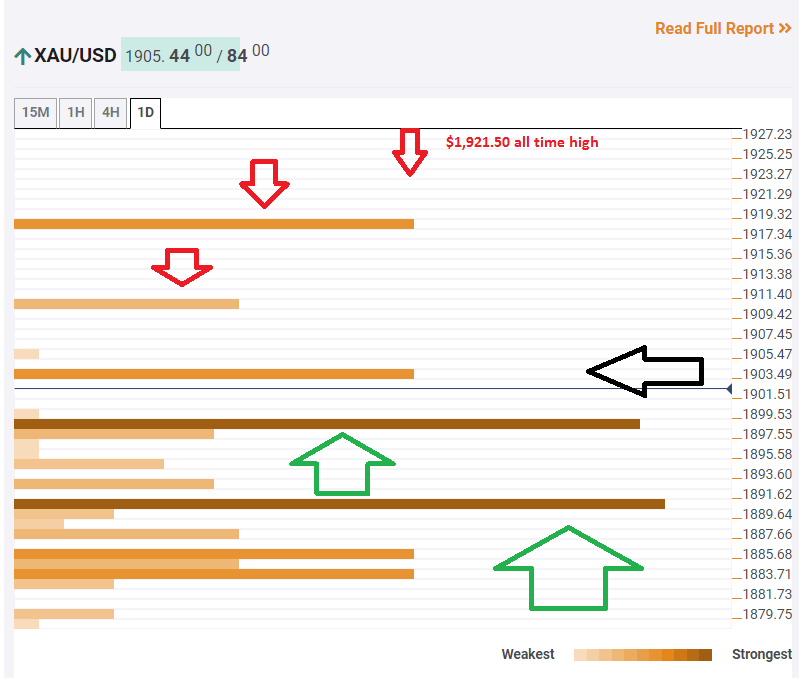

The Technical Confluences Indicator is still battling the $1,903 level, which is where the Pivot Point one-day Resistance 1 hits the price.

It is followed by $1,910, which is where traders find the Bollinger Band four-hour Upper.

The next hurdle is $1,918, where the PP one-day R2 awaits and it is the last cap before the all-time high of $1,921.50, recorded in 2011.

Strong support is at $1,958, which is the convergence of the previous daily high and the BB 1h-Upper.

The next considerable cushion is at $1,890, which is the confluence of the teh Fibonacci 23.6% one-day and the SMA 50-15m

Key XAU/USD esistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence