ECB's Schnabel Interview with Expansión:Balance of risks is still tilted to downside

In an interview Isabel Schnabel, member of the executive board of the ECB, conducted by Andrés Stumpf on 16 July and published on 21 July 2020, he states that the balance of risks is still tilted to the downside.

A link to the full interview is published don the ECB's website, here.

Some key comments from the interview

Our decisions are guided by the incoming data, so we continuously monitor what is happening in the economy and financial markets.

Our measures take time to fully take effect.

Markets must be careful not to read too much into data that show short-term variations in the pace of our asset purchases.

The PEPP envelope was calibrated to meet two objectives: to counter the risks to the medium-term inflation outlook due to the pandemic, and to prevent market fragmentation and ensure the transmission of our policy to the entire euro area.

Not so long ago, many people were saying that the ECB had run out of ammunition. Our response to this crisis has clearly shown that we have a large and effective monetary policy toolbox at our disposal.

Whenever we take a new measure, some market participants already predict that we are going to do more. It is important that markets properly understand our reaction function. We link our decisions to the developments that we see in the data. It is crucial to avoid a situation in which the markets end up dictating what decisions we take.

At least for the moment, we have not seen waves of rating downgrades for companies or countries that are on the brink of losing their investment grade ratings. So there is no urgency for us to discuss this now in relation to our asset purchases.

EUR/USD outlook

A great deal hinges on the outcome of the COVID-19 rescue package's resolve this week if there will be one.

EU reportedly proposes €750 billion in coronavirus stimulus fund – Bloomberg

There are signs that some progress will be made regarding the European Commission’s proposed Recovery Fund which is helping to support the single currency across the board.

So long as risk appetite lingers for longer and the DXY continues to slide, then the prospects for a higher euro remain plausible.

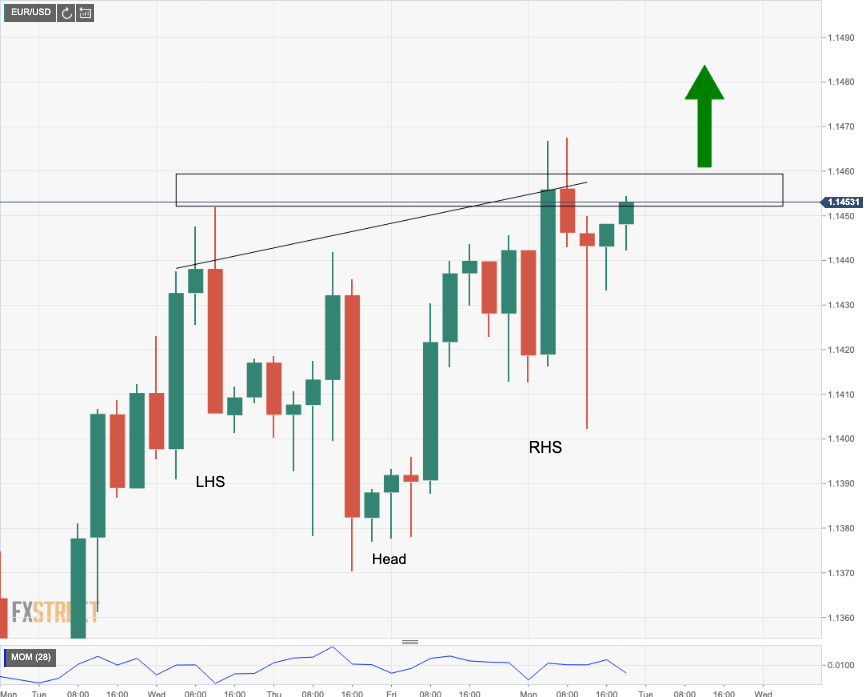

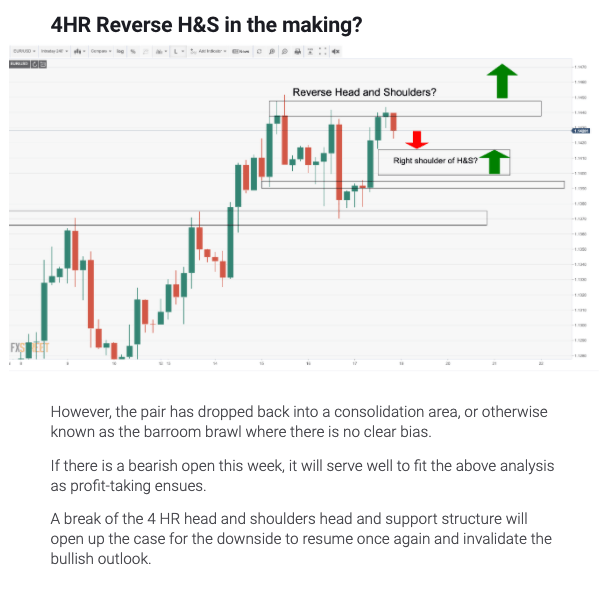

Technically, we have already seen the predicted head and shoulder's partial confirmation taking shape:

(From the following analysis published 19th July: The Chart of the Week: EUR/USD to complete a reverse H&S prior to next leg higher?)

4HR Reverse H&S