Back

7 May 2020

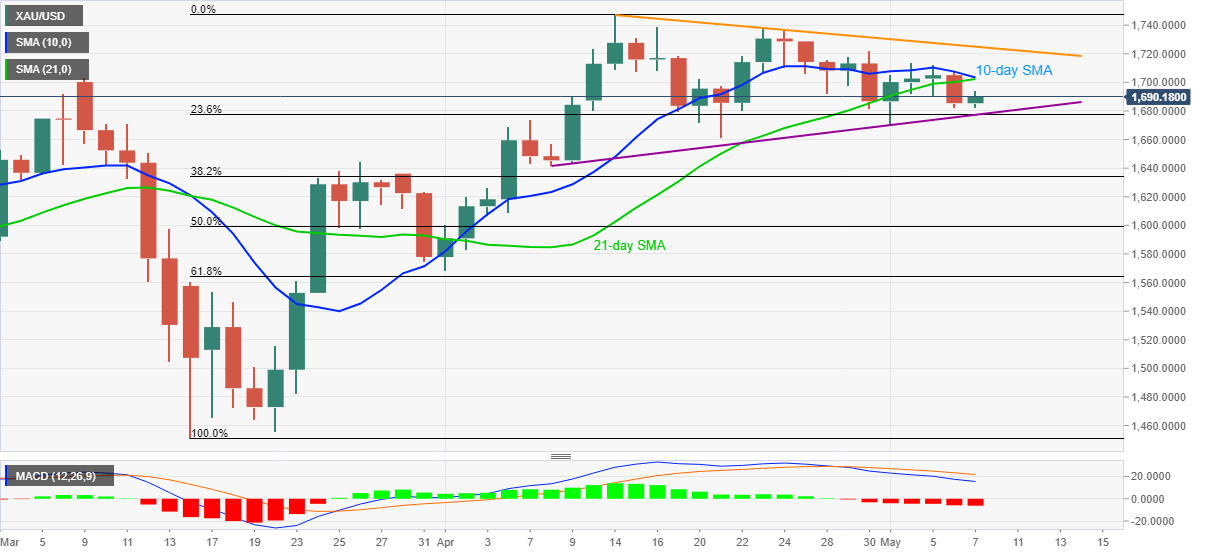

Gold Price Analysis: 10/21-day SMA guards pullback around $1,700

- Gold fails to extend the previous day’s losses.

- Bearish MACD, trading below key SMAs keep sellers hopeful.

- A three-week-old falling trend line adds to the upside barriers.

Having bounced off four-day low, Gold prices print 0.30% gains on a day while taking the bids to $1,690.44 on early Thursday.

Even so, the yellow metal remains below a confluence of 10 and 21-day SMA, around $1,702/03 now.

Also likely to challenge the buyers is the falling trend line from April 14, currently near $1,725, a break of which enables buyers to aim for April month top near $1,748.

Meanwhile, a joint of 23.6% Fibonacci retracement of March-April upside and monthly ascending trend line, close to $1,677, acts as the near-term key support.

Should there be a clear downside past-$1,677, April 08 low near $1,641 could lure the sellers.

Gold daily chart

Trend: Sideways