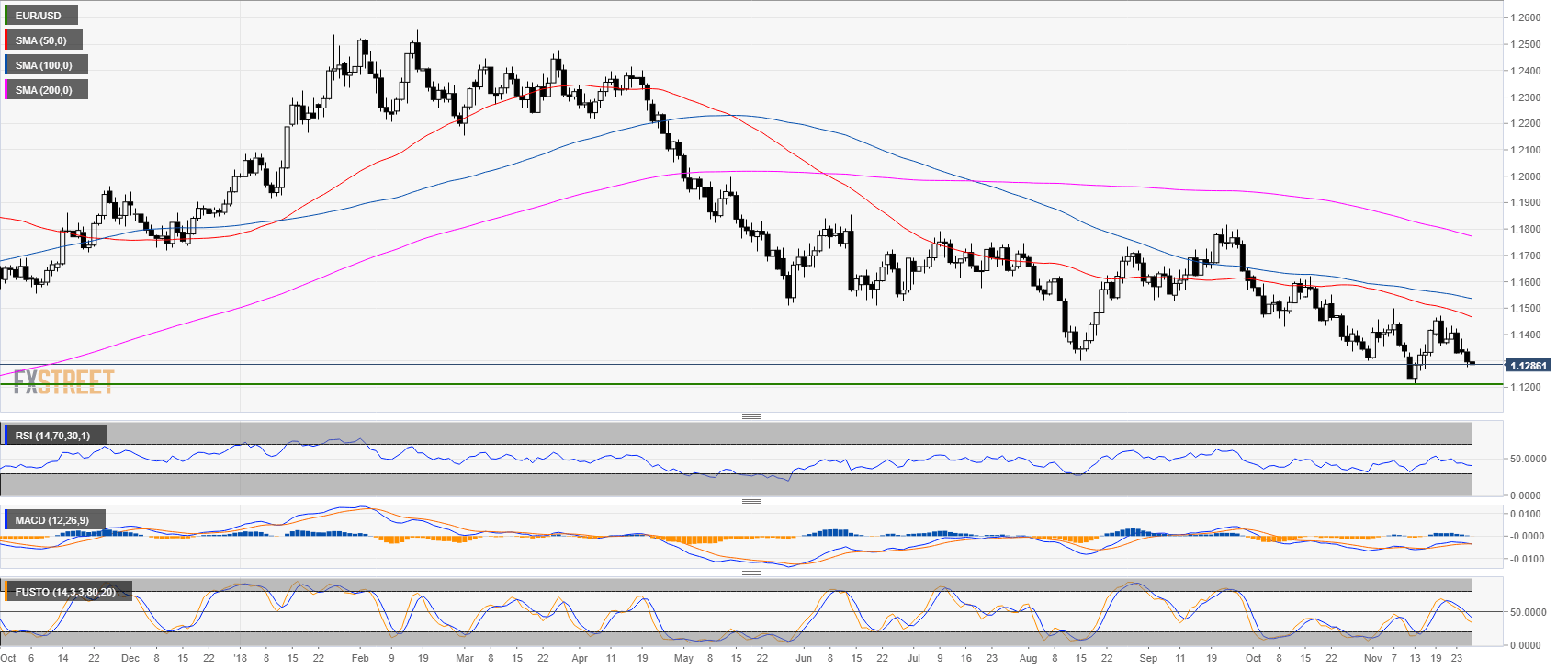

EUR/USD Technical Analysis: Euro hovering just below 1.1300 figure ahead of Fed Powell speech

EUR/USD daily chart

- EUR/USD is trading in a bear trend below its 200-day simple moving average (SMA).

- Technical indicators are negative suggesting a bearish bias.

- Fed’s Powell is delivering a speech at 17.00 GMT which can cause turmoil in the forex market. Indirectly Bank of England’s Governor Carney speech at 16.45 GMT can also affect EUR/USD.

EUR/USD 4-hour chart

- Although EUR/USD is trading in a bear trend, the bears are likely exhausted as the market is oversold.

- The major resistances to the upside are located near the 1.1325 and 1.1375 level.

- A break of 1.1275 support can lead to a quick run to 1.1200 figure which is expected to hold prices.

EUR/USD 30-minute chart

- On lower time-frames, EUR/USD is trading below its main SMAs while technical indicators are somewhat neutral.

- EUR/USD is evolving in a weak bear trend as the market is down about 50 pips since the start of the week. While the trend is your friend, the potential move down to 1.1200 is likely a bear trap that can reverse up any time.

Additional key levels

EUR/USD

Overview:

Today Last Price: 1.1288

Today Daily change: -8.0 pips

Today Daily change %: -0.0708%

Today Daily Open: 1.1296

Trends:

Previous Daily SMA20: 1.1362

Previous Daily SMA50: 1.1473

Previous Daily SMA100: 1.154

Previous Daily SMA200: 1.178

Levels:

Previous Daily High: 1.1346

Previous Daily Low: 1.1277

Previous Weekly High: 1.1473

Previous Weekly Low: 1.1328

Previous Monthly High: 1.1625

Previous Monthly Low: 1.1302

Previous Daily Fibonacci 38.2%: 1.1303

Previous Daily Fibonacci 61.8%: 1.1319

Previous Daily Pivot Point S1: 1.1267

Previous Daily Pivot Point S2: 1.1238

Previous Daily Pivot Point S3: 1.1199

Previous Daily Pivot Point R1: 1.1336

Previous Daily Pivot Point R2: 1.1375

Previous Daily Pivot Point R3: 1.1404