USD/JPY retreats from highs, back near 111.60

After a brief test of daily highs near 111.90, USD/JPY has now lost some upside momentum and is now receded towards the 111.60 area.

USD/JPY focus on US data, FOMC, BoJ

Spot keeps the march north unabated so far today, extending the rally for the third consecutive session to fresh 8-week tops in levels just below the critical 112.00 limestone.

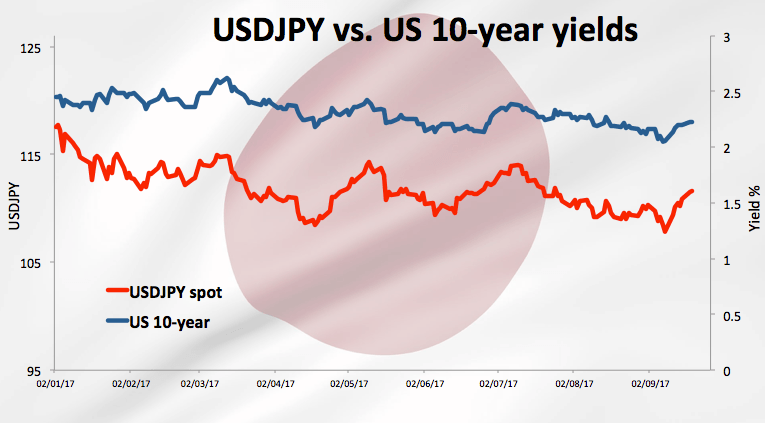

The sharp rebound in yields of the key US 10-year reference is giving extra oxygen to the pair’s uptick, all coupled with increasing selling bias surrounding the Japanese safe haven currency.

USD/JPY is expected to come under pressure, however, in light of the imminent monetary policy meetings of the Federal Reserve and the Bank of Japan on Wednesday and Thursday, respectively.

Later today, US building permits, housing starts and export/import prices are due later, while August’s trade balance figures in Japan are expected early on Wednesday.

USD/JPY levels to consider

As of writing the pair is gaining 0.05% at 111.62 and a breakout of 111.88 (high Sep.19) would open the door to 112.25 (200-day sma) and then 112.82 (76.4% Fibo of 114.51-107.32). On the other hand, the immediate support emerges at 111.14 (100-day sma) seconded by 110.70 (55-day sma) and finally 110.07 (38.2% Fibo of 114.51-107.32).