Euro weakens to daily lows and returns to the sub-1.0900 region ahead of key data

- Euro kicks in the week on the back foot on US Dollar recovery.

- Stocks in Europe open the week within tight ranges.

- EUR/USD slips back below the 1.0900 support on Monday.

- Final Manufacturing PMIs take centre stage later in the session.

- US ISM Manufacturing PMI will be in the limelight in NA trading hours.

At the start of the new trading week, the Euro (EUR) is under noticeable pressure, retracing part of Friday's strong gains and forcing EUR/USD to drop below the key support level of 1.0900 the figure.

Meanwhile, the US Dollar (USD) is showing a better performance, with the USD Index (DXY) gaining renewed strength and surpassing the key level of 103.00, despite the lack of direction in US yields on Monday.

The potential future actions of the Federal Reserve and the European Central Bank (ECB) in normalizing their monetary policies remain a topic of ongoing debate amidst increasing speculation about an economic slowdown on both sides of the Atlantic. Currently, bets remain firm that there will be a 25 basis point rate increase by both central banks at their meetings in July.

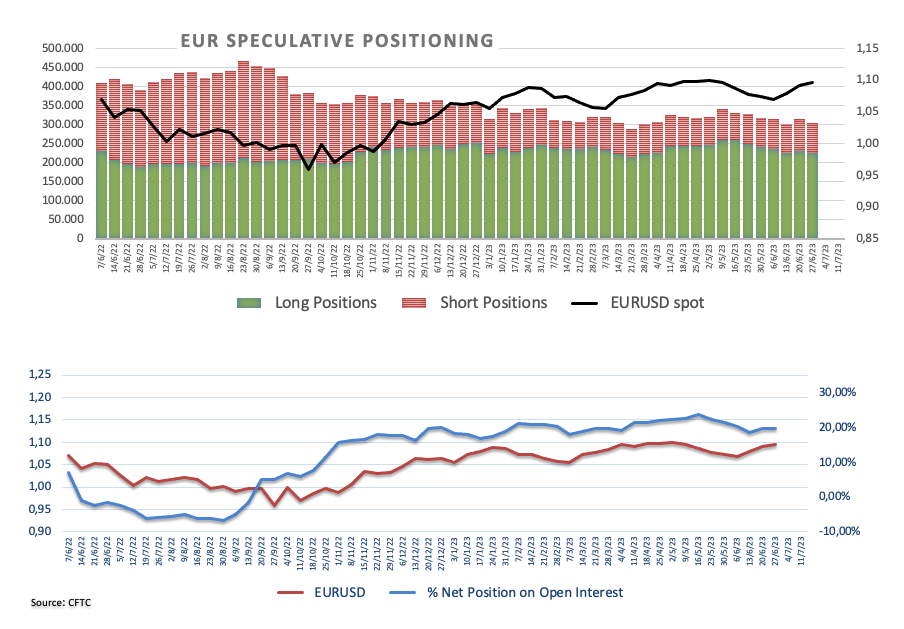

Looking at the latest CFTC Positioning Report, net longs in EUR remained steady and reached a 2-week high of around 145K contracts in the week ending June 27, despite the spot reaching new monthly highs above 1.1000, which ultimately fizzled out due to the recovery in the risk-off trade and buying interest in the USD.

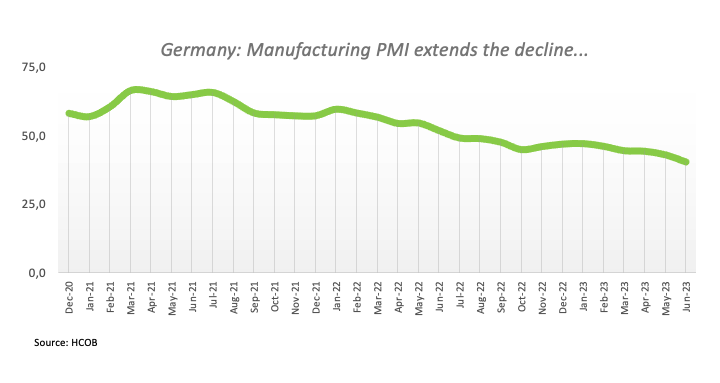

In terms of economic data, the final Manufacturing PMI figures for the euro area and Germany in June were 43.4 and 40.6, respectively.

Meanwhile, in the US, the ISM Manufacturing PMI will be the centre of attention, alongside the final S&P Global Manufacturing PMI and Construction Spending.

Daily digest market movers: Euro appears offered amidst US Dollar gains

- The EUR reverses course and retreats to the sub-1.0900 zone.

- US markets face a shortened trading week due to Independence Day.

- Chinese Caixin Manufacturing PMI failed to surprised markets.

- The probability of a Fed rate hike is near 88%.

Technical Analysis: Euro could revisit the 100-day SMA

EUR/USD appears under pressure and risks a potential deeper drop in case the selling bias picks up pace. That said, the loss of the weekly low at 1.0835 (June 30) could open the door to a test of the interim 100-day SMA at 1.0819. The breakdown of the latter should meet the next contention area not before the May low of 1.0635 (May 31) ahead of the March low of 1.0516 (March 15) and the 2023 low of 1.0481 (January 6).

If bulls regains the upper hand, the next hurdle is then expected at the June peak of 1.1012 (June 22) prior to the 2023 high of 1.1095 (April 26), which is closely followed by the round level of 1.1100. North from here emerges the weekly top of 1.1184 (March 31, 2022), which is supported by the 200-week SMA at 1.1181, just before another round level at 1.1200.

The constructive view of EUR/USD appears unchanged as long as the pair trades above the crucial 200-day SMA, today at 1.0595.