EUR/USD Price Analysis: Bears engage again in 1.1020 resistance

- EUR/USD bears are engaging again but the support could be solid ahead of Nonfarm Payrolls.

- EUR/USD 1.0980s are key for the day ahead.

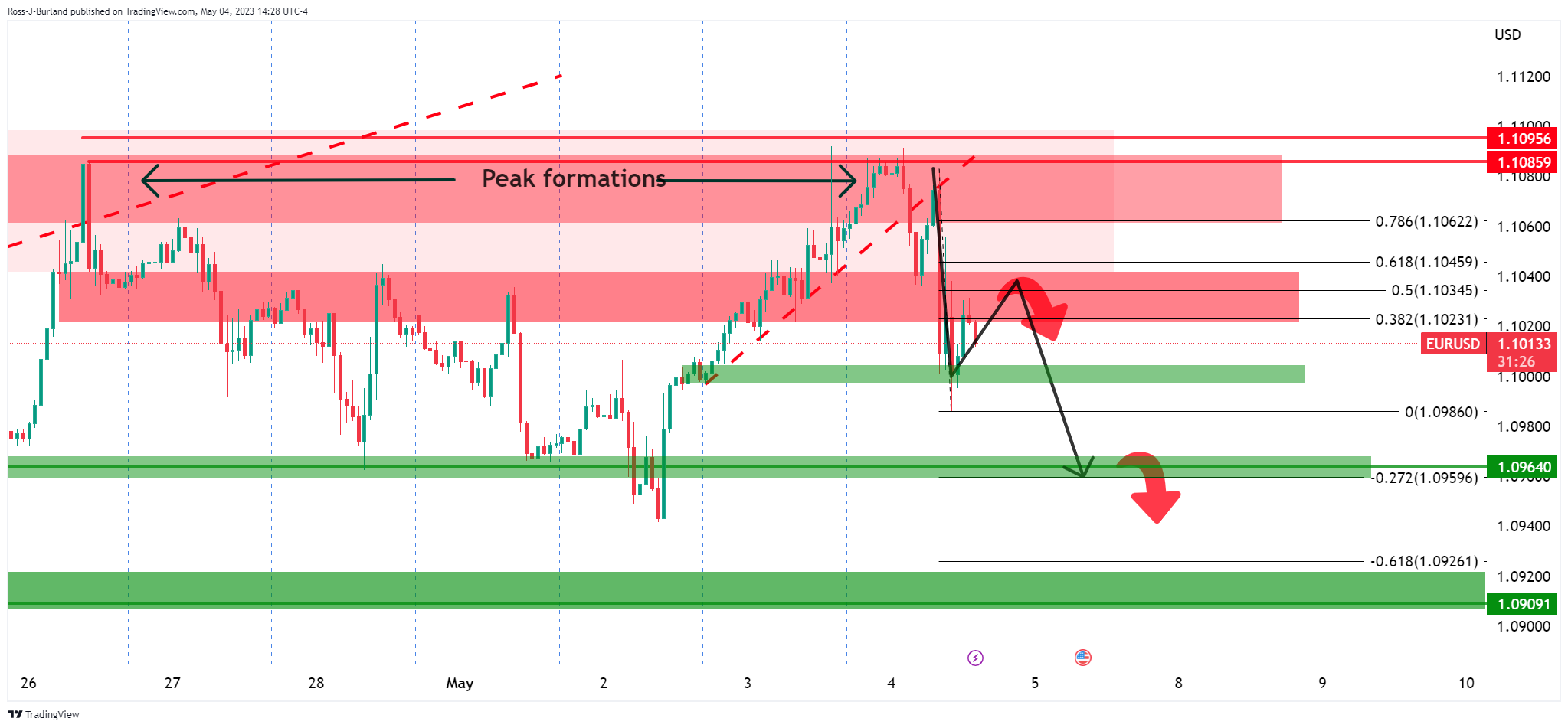

The bias remains bearish with low-hanging fruit for the bears to pick off on a break below 1.1000 with eyes on the 1.0950s. However, should the bulls commit at the current support, the market could easily turn higher to the 1.1050s as a key resistance area that guards the recent highs near 1.1100:

EUR/USD was giving back some of its overnight gains after the European Central Bank eased the pace of its rate hikes, enabling the bears a free lunch from the top of the peak formation as the following technical analysis will illustrate:

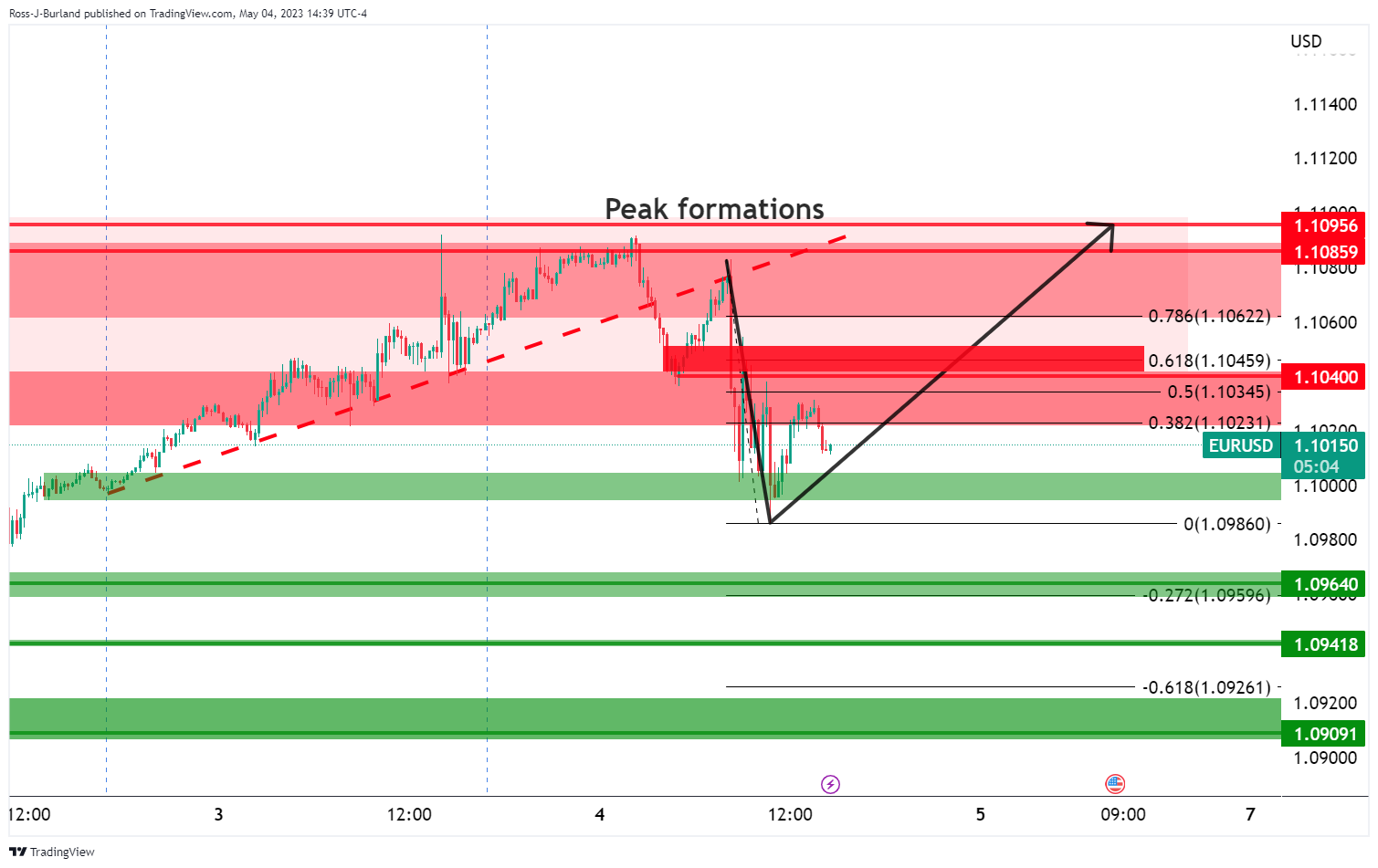

EUR/USD H1 charts

EUR/USD met resistance in a 38.2% Fibonacci and a 50% mean reversion at the height of the correction following the slide from the ECB outcome.

The bias remains bearish with low-hanging fruit for the bears to pick off on a break below 1.1000 and 1.0980 with eyes on the 1.0950s. However, should the bulls commit at the current support, the market could easily turn higher to the 1.1050s as a key resistance area that guards the recent highs near 1.1100:

EUR/USD M15 chart